The BOS platform provides Capital Market firms with a unified platform to capture, track, control, and manage all their trading activities—including complex trading agreements such as CSA, Soft$ and CMTA.

The BOS platform provides Capital Market firms with a unified platform to capture, track, control, and manage all their trading activities—including complex trading agreements such as CSA, Soft$ and CMTA.

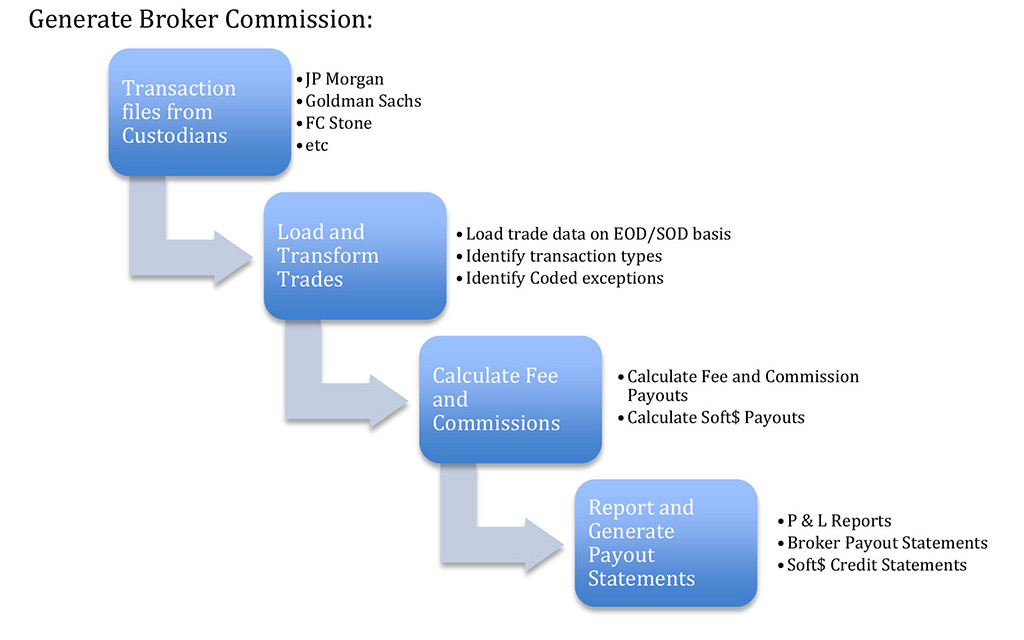

Our proprietary calculation engine automatically evaluates all your:

- Fixed and variables costs of trading (e.g. execution costs, clearing charges, SEC fees etc.)

- Commissions owed and paid

- Trading expenses and revenues

The calculation engine also allows you to easily create tiered payout rules based on any payout structure and have these various calculations clearly displayed in any payout report. You can easily define or adjust these rules at any time using the payout definitions templates provided within the system.

You can see all the relevant numbers through the BOS interface or have them published in most standard formats (most commonly in Excel and PDF). Our reporting engine is highly configurable and can be precisely tailored for your exact needs—including fully customized reports (available on request).

Almost anything in the BOS platform can be fully customized to suit your exact operational procedures and preferences. We make BOS fit YOUR needs, rather than the other way round.

The main benefits provided by the BOS platform include:

- Complete knowledge about all trades and trading agreements executed through your firm

- Comprehensive information about all trading transactions, sorted and filtered to your choosing

- Insight into your most and least profitable activities by client, trader, business unit, etc.

- Control over all aspects of your trading activities (except rates set by external agencies)

- Built-in audit trail of all your trading activities and commission payouts

- Comprehensive and highly scalable solution designed specifically for Capital Market Firms

- Easy monitoring of your historical performance